Follow Adam:

For press inquiries, TV/Radio projects, media bookings or speaking engagements

Travis Taylor

Press Contact

Email

Office / SMS: (415) 745-1416

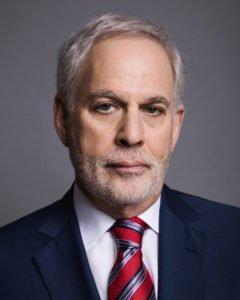

Adam K. Levin is a consumer affairs advocate and serial entrepreneur with more than 40 years of experience. He is a nationally recognized expert on cybersecurity, privacy, identity theft, fraud, and personal finance. At age 27, Levin became the youngest Director in the history of the New Jersey Division of Consumer Affairs — one of the most powerful consumer protection agencies in the U.S. He is a graduate of Stanford University and the University of Michigan School of Law.

As Chairman and founder of CyberScout, Levin built a premier global identity, data protection company, and helped pioneer the cyber insurance business. The organization was acquired in March 2021 by Sontiq, which was soon after acquired by Transunion. Levin was also co-founder of Credit.com, one of the first credit education, information and products and services companies on the Internet focused on consumer credit building. The company was acquired in 2015 by Progrexion.

Mr. Levin’s mission has remained steadfast throughout his career: educate consumers, businesses, law enforcement officials and lawmakers about consumer privacy, identity management and protection, credit, and, later, election security issues. In addition to the AdamLevin.com website, which regularly features his writing, Levin is the author of the critically acclaimed book “Swiped: How to Protect Yourself in a World Full of Scammers, Phishers, and Identity Thieves.” A weekly column appeared on ABC News, The Huffington Post, Yahoo!, AOL, MSN, and MarketWatch, and his articles have appeared in many publications, including, Inc., The Hollywood Reporter, The Hill, Bloomberg and The New York Times. He is host of the podcast “What the Hack with Adam Levin.”

Levin’s regular appearances on television and radio include The Today Show, CBS Evening News, Good Morning America, CNBC Closing Bell, Bloomberg Surveillance, Fox Business, Fox & Friends, ABC World News Tonight, ABC News Nightline, PBS Nightly Business Report, NPR, ABC News Radio, Bloomberg Radio, among others.

A highly sought expert, Levin has testified before state and federal regulators as well as legislative committees on his areas of expertise. He routinely addresses cybersecurity, financial services, insurance, educational and law enforcement organizations throughout the United States and Europe.