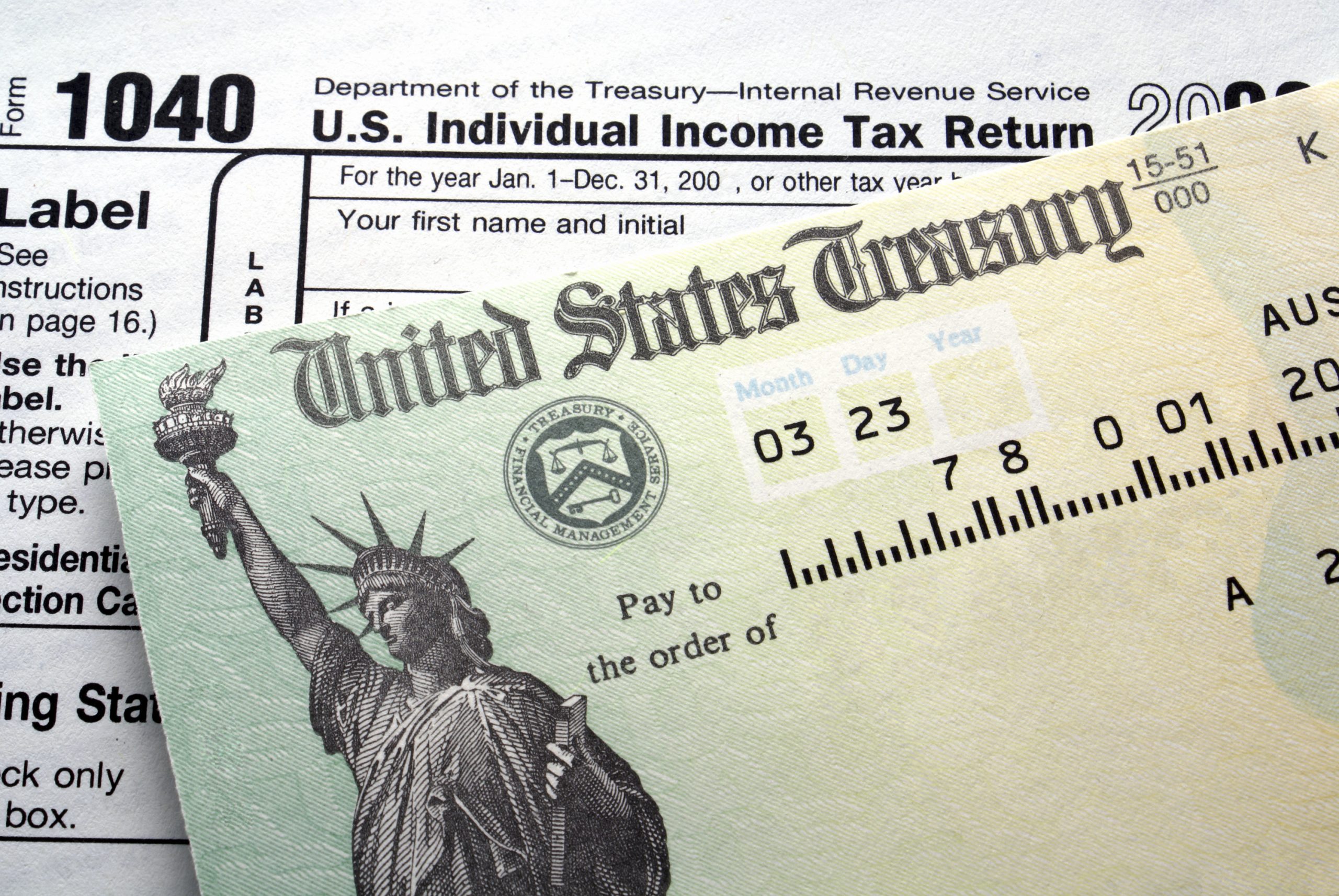

In the past several years, millions of U.S. taxpayers have experienced the frustration of attempting to file their taxes, only to find that someone beat them to it: Tax-related identity theft is a common crime, in which people use stolen information (mostly Social Security numbers) to fraudulently obtain tax refunds. Then, when the rightful owner of that Social Security number attempts to file taxes, the IRS flags the return as a duplicate, and consumers end up waiting months, sometimes years, to receive their refunds.

During tax year 2013 (the most recent data available), the Internal Revenue Service lost $5.2 billion to identity theft, despite preventing $50 billion in tax-refund fraud. The problem isn’t going away, so the IRS recently announced new plans to curb such fraud, including more complex taxpayer-authentication processes.

Given how far away tax season is, it’s unclear how these changes might affect consumers’ tax-filing experiences, but the changes seem to be geared toward the tax-preparation industry, rather than taxpayers.

“It looks to me that this is all going to be happening behind the scenes,” said Stephen W. DeFilippis, an Enrolled Agent in Wheaton, Ill. Enrolled Agents are tax practitioners federally licensed to represent taxpayers before the IRS. “If it does delay anything I’m sure we’re not going to hear about it until right before filing season.”

That’s where things are at right now: The IRS and others in the tax space are working to improve fraud prevention, but consumers may not yet notice the changes. You should keep doing what you’re (hopefully) doing by filing your taxes as early as possible, while keeping an eye on your credit scores and credit reports for signs of identity theft. Meanwhile, here’s what will be unfolding in the background when you file your taxes in 2016, according to the IRS news release on the initiative.

Information Sharing

The IRS announced it would collaborate with other groups in the thick of tax preparation in order to better detect fraud. This includes tax preparation and software firms; state tax administrators; and payroll and tax financial product processors. The idea of sharing information is to better track down fraud leads and identify patterns of fraud schemes.

“Anything that can be done to increase information sharing that doesn’t violate the privacy of consumers is a good thing,” said Adam Levin, chairman and co-founder of Identity Theft 911 and Credit.com. “It’s important for institutions to share as much knowledge of what they’re seeing out there. …The biggest problem that they’re facing is the astronomical amount of data that’s accessible by bad guys.”

Taxpayer Authentication

The collaborating institutions will analyze data like repetitive filing from a certain IP address and how much time it takes to file a return. Tax preparation software will submit this data with the return to the state and federal tax authorities to aid in fraud-detection efforts.

There aren’t many more details out there on the changes or how they’ll impact consumers.

“They’re being somewhat secretive, which I understand,” DeFilippis said of the information thus far provided by the IRS. “I would think that hopefully by fall we would get some clarity and if there are certain things that taxpayers can be doing to safeguard their information and minimize the danger of having a fraudulent return filed under their Social Security number.”

New fraud-prevention measures aside, the best thing consumers can do is file their taxes as soon as possible, but DeFilippis noted that’s often beyond individuals’ control, because tax paperwork is sent out over several weeks. Levin said it’s good to see the IRS working to increase consumer protection, but that doesn’t lessen the importance of self-protection.

“The IRS is stepping up its game, and the entire government is stepping up its game, but this is where there is no alternative: We have to step up our game,” Levin said. “We have to make absolutely sure we know who we’re communicating with, we have to monitor frequently through any number of mechanisms — credit reporting, credit scores — and we need to have a damage control program.”

As soon as you see signs of identity theft, like unexpected changes in your credit reports or scores, waste no time in investigating. You can check your credit scores for free every month on Credit.com.

This article originally appeared on Credit.com and was written by Christine DiGangi.